There have been many reports in the media about the performance of the property market — more opinion than fact. Over the years you’ve been reading my updates, you know me well enough to know that I like the facts.

There are some key drivers in any property market: employment levels, net migration, crowding, property sale volumes, construction, affordability, rents, and number of days to sell property to name a few. All of these remain at relatively stable levels.

The first home buyer market is certainly buoyant (new mortgage registrations rose from 24.8% to 26.4% last month) with lenders easing up on restrictions along with attractive interest rates — with no predictions of tightening anytime soon.

Changes to LVR's

The RBNZ Financial Stability Report released on Wednesday the RB noted the slowing in mortgage lending growth and house price inflation. In response they have cut the minimum deposit requirement for investors from 35% to 30% (having cut it from 40% a year ago). And banks may now have up to 20% of their lending to owner occupiers at less than 20% deposit. This had been 15% from the earlier 10% percentage of volume limit.

Will these changes affect property values?

Not really. At least, they certainly won’t lead to large rises in house prices, but the changes should bring further stability to the market. Remember when they imposed the changes as the market was rising? They were never to bring house prices down, they were just to slow the growth and stabilise the market. Now it’s the reverse.

The sellers market has passed (2 years ago), but the balanced market environment we are presented with is a healthy one. Values remain relatively stable along with stock levels and sales volumes. I see this property climate remaining similar for a few years yet.

We are entering the winter period and typically the market starts to go quiet, but people still buy and sell property. The winter months are typically slower with less volume than the summer months, which gives buyers and sellers more time to consider opportunities.

Recent research conducted by realestate.co.nz finds that more buyers than sellers intending to be active in the New Zealand property market in the next 12 months. Real time statistics from realestate.co.nz show the current market nationally is relatively stable.

The Auckland region pulled down the overall national number of new listings with a 4.4% fall compared with the same period last year, but this was balanced by a lift in new listings in 13 of the 19 regions.

The average asking price for a New Zealand home is $648,218 representing a 0.4% decrease on April 2018.

Source

Martin Cooper, owner of the largest Harcourts franchise on the North Shore — Cooper & Co — sums it up well when he says, ''Something I have observed about human behaviour after 33 years in real estate, is that when people are making major buying or selling decisions they do not like uncertainty. In uncertain times, people tend to hold off until they know what is happening. The usual phrase I hear — and you may have heard it before too — is, ‘We’ll just wait and see.’

“Now that we have certainty, I’m certain we are going to see a big uplift in the number of sales as we progress through to Christmas and the New year.''

The graph below tracks the number of residential sales from the 2014 election year to the present, where we can see a dramatic increase in the numbers post-election (2015–2016).

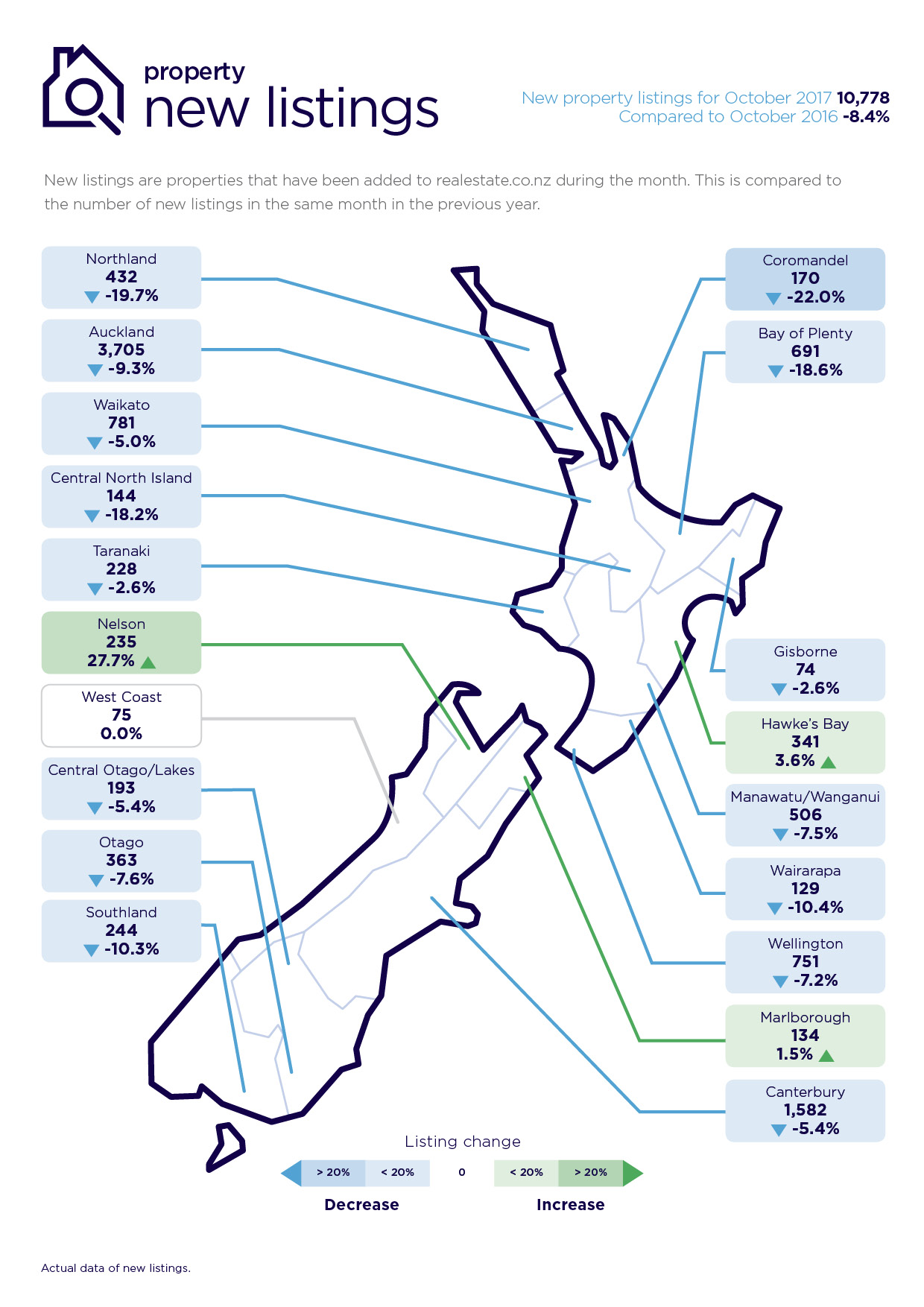

This past decade has seen a steady increase in asking prices while the total stock for sale continues to fall. In fact, the latest report in shows the number of homes for sale has gone down by nearly 50% compared to 10 years ago. In Auckland, the number of new listings fell 9.3% compared to October 2016.

This is also reflected in Auckland’s property asking price, which has been largely static over the past year (between zero and one 1% change in asking price each month). The average Auckland region asking price in October 2017 is $937,922.

We are finding that Auckland home owners are being realistic with price expectations now that we are in a balanced, normal market.

You may have seen an article in the NZ Herald mentioning Auckland house values have dipped for the first time in six years.

I would like to highlight that this dip was very marginal at 0.6% compared to this time last year, and values in Auckland are 90% higher than they were in 2007.

The previous rises were not sustainable and we are simply seeing the housing market stabilising.